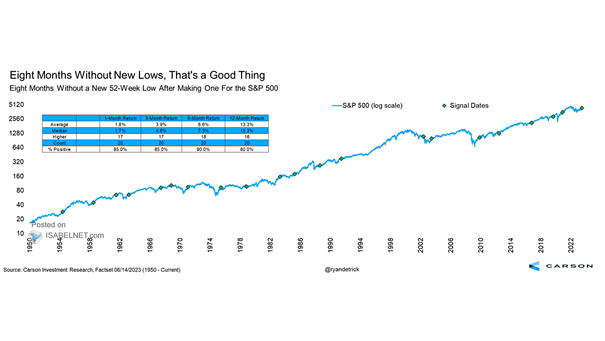

Eight Months Without a New 52-Week Low After Making One for the S&P 500

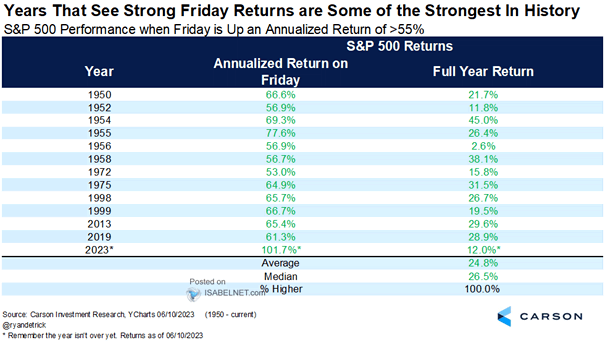

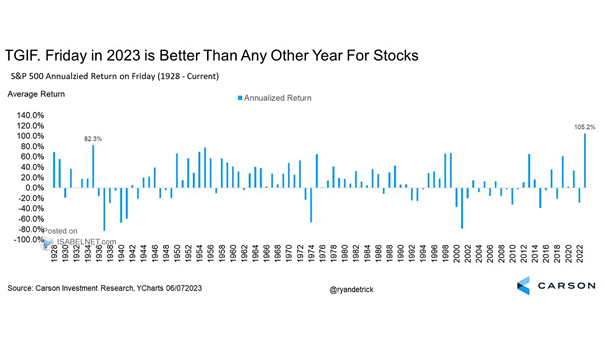

Eight Months Without a New 52-Week Low After Making One for the S&P 500 Eight months without a new 52-week low for the S&P 500 is a bullish sign that tends to lead to further gains. Image: Carson Investment Research