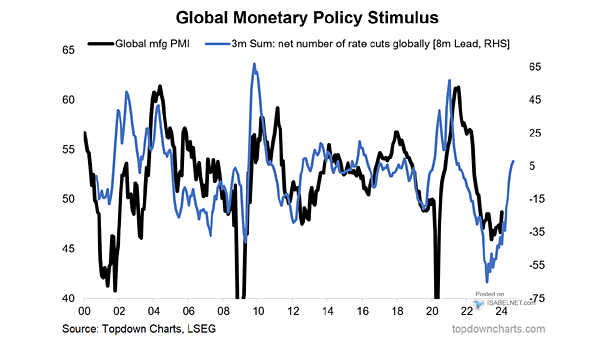

Global Monetary Policy Stimulus and Global Manufacturing PMI

Global Monetary Policy Stimulus and Global Manufacturing PMI The dominant macro theme for 2026 is a global growth rebound, fueled by two years of aggressive monetary easing that have laid the groundwork for renewed economic momentum worldwide. Image: Topdown Charts