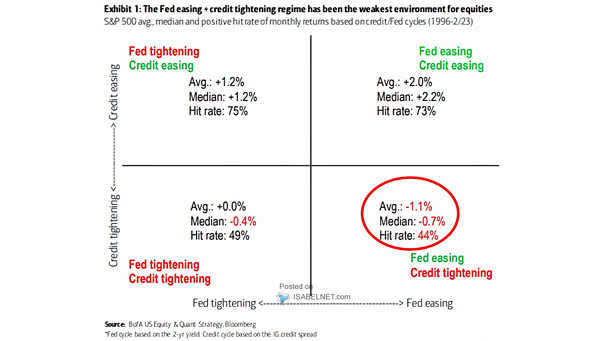

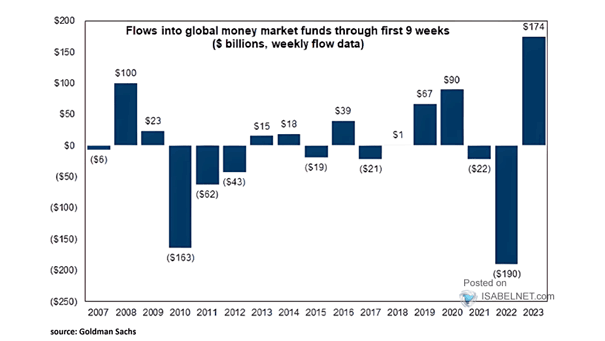

S&P 500 Average Median and Positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles

S&P 500 Average Median and Positive Hit Rate of Monthly Returns Based on Credit/Fed Cycles Fed easing and credit tightening regime does not bode well for U.S. equities. Image: BofA US Equity & Quant Strategy