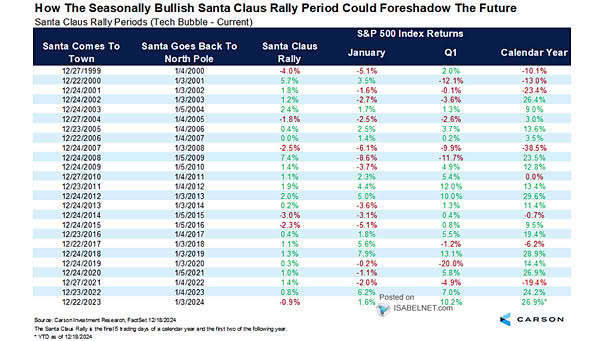

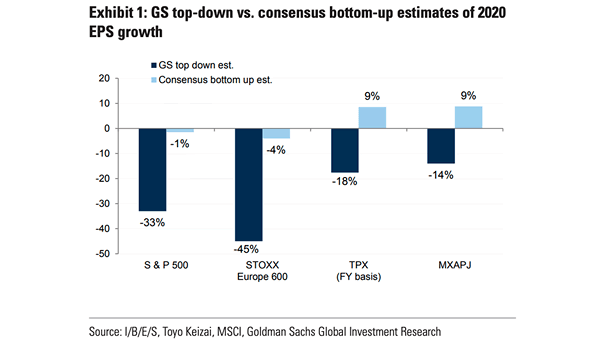

Contribution to Annual S&P 500 Price Return

Contribution to Annual S&P 500 Price Return In 2025, the S&P 500’s gains have come from earnings growth, not rising valuations. That’s a shift from 2023 and 2024, when richer multiples did most of the lifting. Image: J.P. Morgan Asset Management