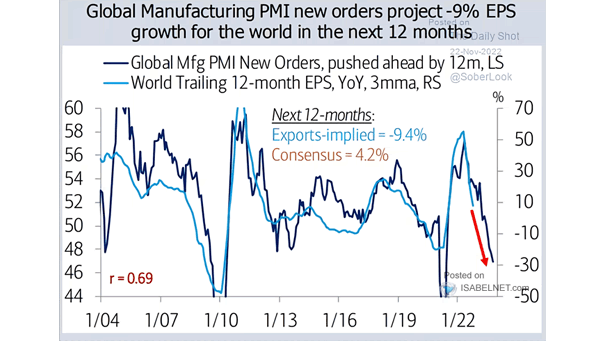

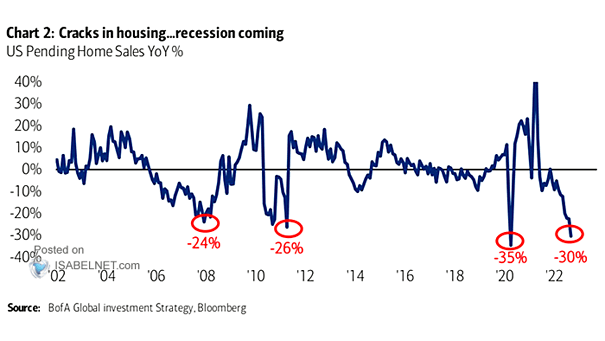

Earnings – Global Manufacturing PMI New Orders vs. World Trailing 12-Month EPS (Leading Indicator)

Earnings – Global Manufacturing PMI New Orders vs. World Trailing 12-Month EPS (Leading Indicator) Global manufacturing PMI new orders tend to lead world EPS growth by 12 months. Image: BofA Global Research