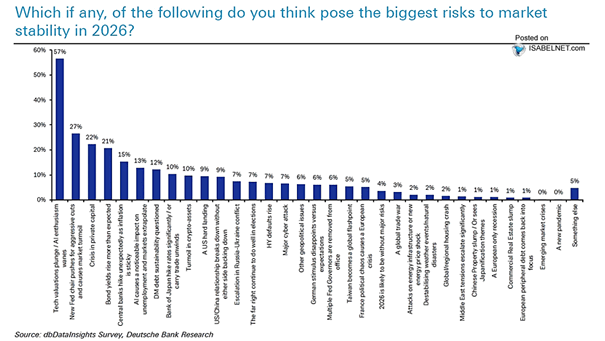

Survey – Biggest Risks to Market Stability in 2026

Survey – Biggest Risks to Market Stability in 2026 A rare consensus is emerging among investors on what could shake markets in 2026. Deutsche Bank’s latest survey finds AI and tech bubble jitters leading the pack, overshadowing concerns about Fed autonomy and private credit stress. Click the Image to Enlarge