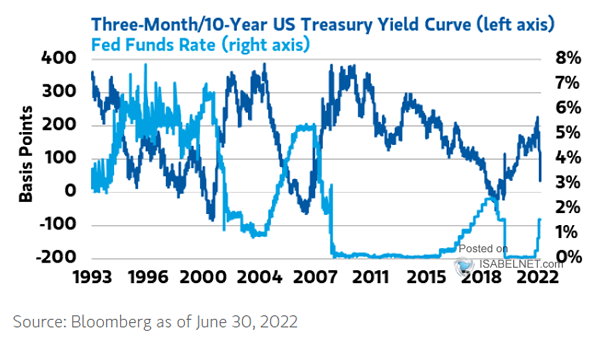

U.S. 10Y-3M Yield Curve and Fed Funds Target Rate

U.S. 10Y-3M Yield Curve and Fed Funds Target Rate Historically, the Fed doesn’t pivot policy until a recession arrives and the 10Y-3M US Treasury yield curve inverts. Is it really different this time? Image: Morgan Stanley Wealth Management