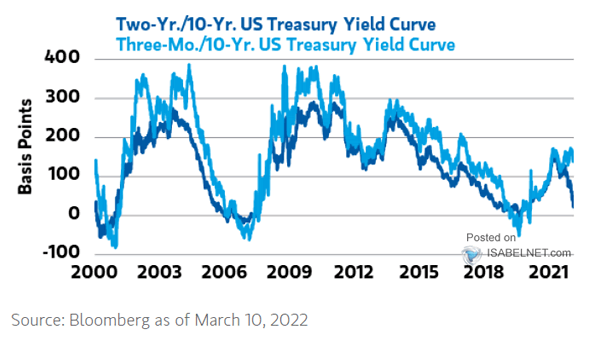

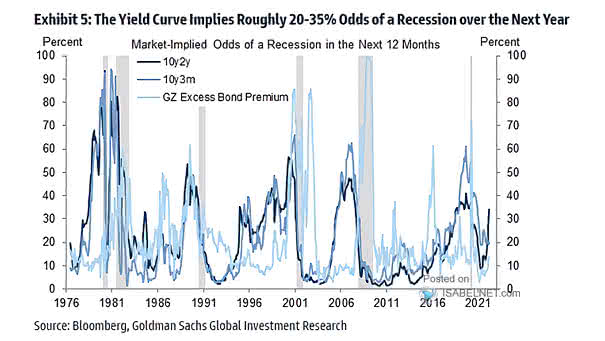

2Y-10Y U.S. Treasury Yield Curve vs. 3M-10Y U.S. Treasury Yield Curve

2Y-10Y U.S. Treasury Yield Curve vs 3M-10Y U.S. Treasury Yield Curve The steepening of the 3-month/10-year U.S. Treasury yield curve suggests that the Fed’s monetary policy tightening could be slower. Image: Morgan Stanley Wealth Management