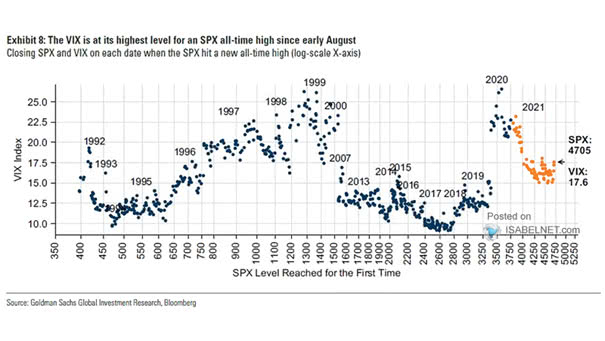

Closing S&P 500 and VIX on Each Date When the S&P 500 Hit A New All-Time High

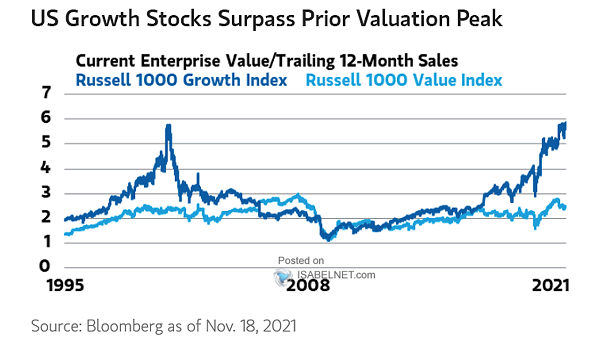

Closing S&P 500 and VIX on Each Date When the S&P 500 Hit A New All-Time High Today’s U.S. stock market looks a lot like the dot-com bubble of the late 1990s. Image: Goldman Sachs Global Investment Research