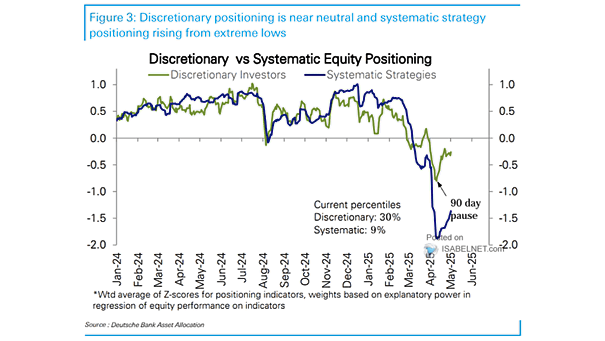

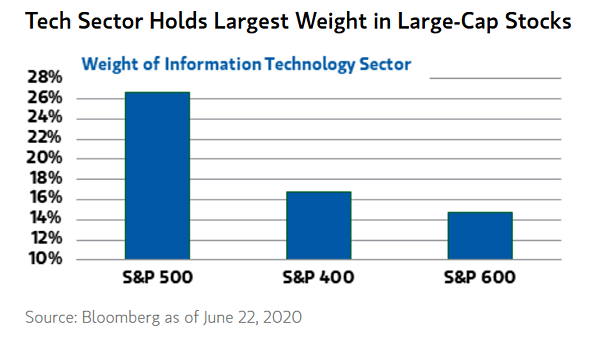

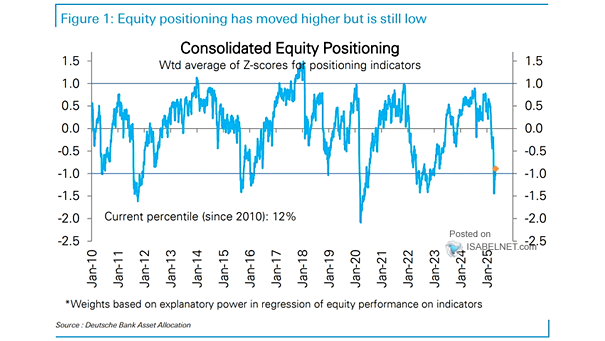

Discretionary vs. Systematic Equity Positioning

Discretionary vs. Systematic Equity Positioning With systematic strategies remaining strong at the 74th percentile and discretionary investors still wary at the 37th percentile, markets have room to edge higher. Image: Deutsche Bank Asset Allocation