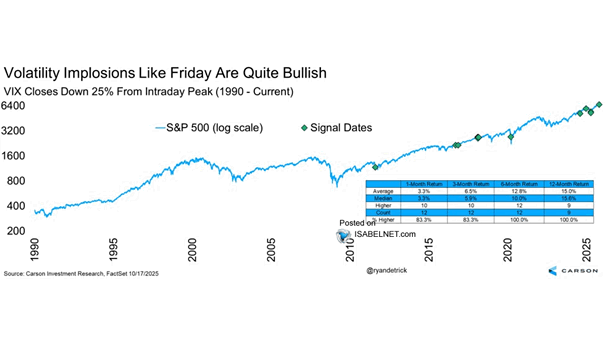

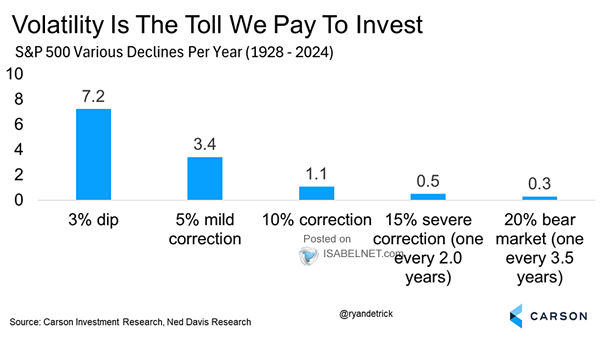

S&P 500 and VIX Closes Down 25% from Intraday Peak

S&P 500 and VIX Closes Down 25% from Intraday Peak Good news for bulls: big fear fades, stocks surge. Each time the VIX finished more than 25% off its intraday high, the S&P 500 was higher six and twelve months later—no exceptions. Since 1990, average one‑year gain: 15%. Image: Carson Investment Research