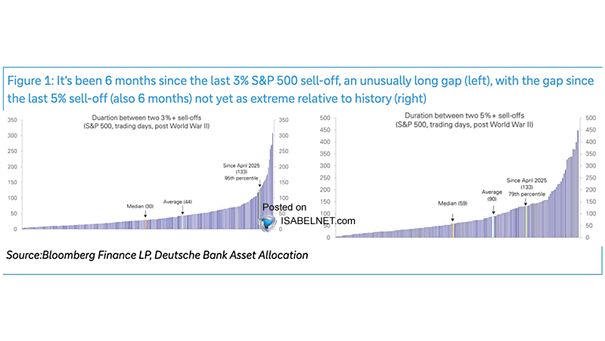

S&P 500 – Duration Between 3%+ and 5%+ Sell-Offs

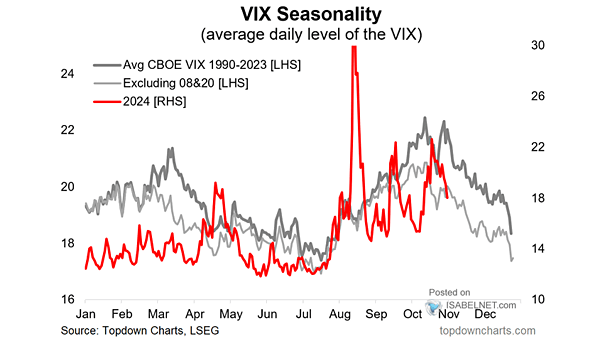

S&P 500 – Duration Between 3%+ and 5%+ Selloffs The S&P 500 hasn’t stumbled more than 3% in half a year—a winning streak that’s beginning to smack of complacency, the kind that often sets the stage for volatility. Image: Deutsche Bank Asset Allocation