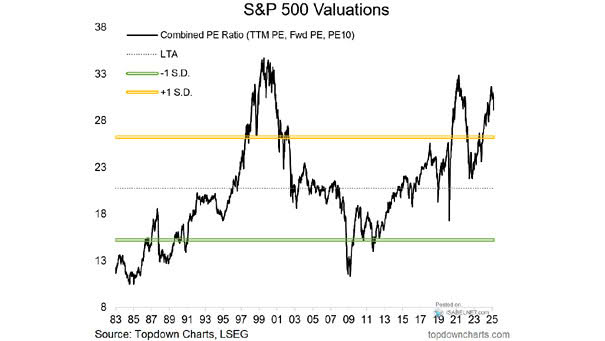

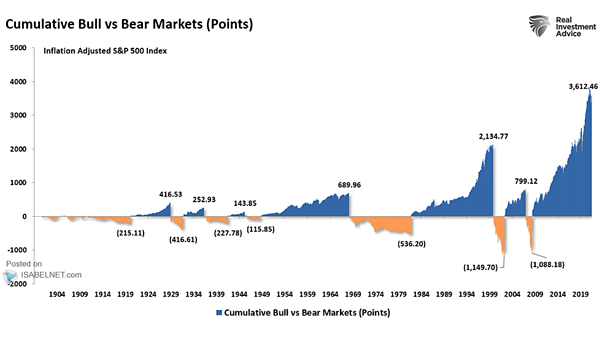

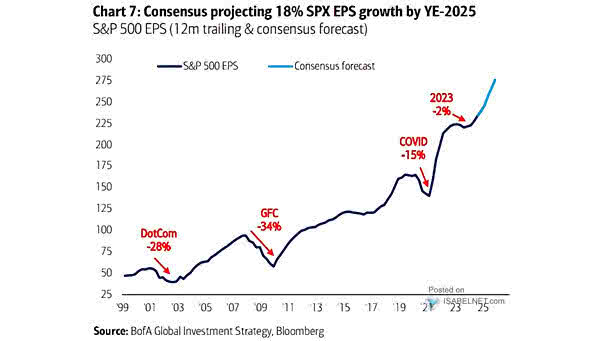

S&P 500 Valuations

S&P 500 Valuations The S&P 500’s current valuation places it alongside two standout episodes of market excess—the late-1990s dot-com mania and the 2021 stimulus-fueled rally—raising a yellow flag for investors who fear a stretch of muted returns. Image: Topdown Charts