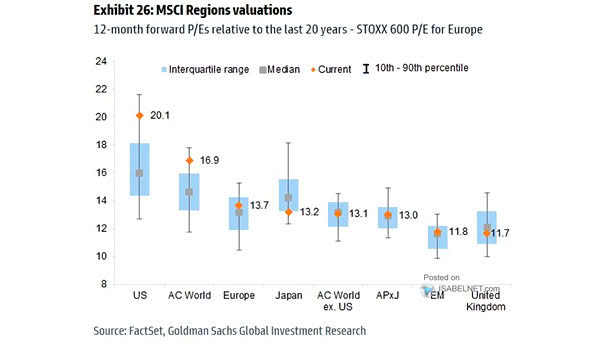

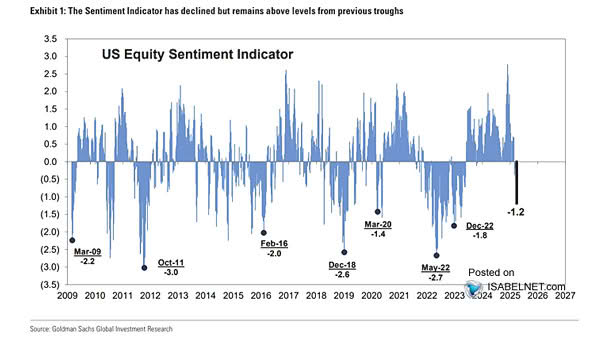

Equities – Global Valuation Range

Equities – Global Valuation Range U.S. stocks remain priced at a hefty premium, while valuations outside the U.S. are closer to historical norms. That leaves global markets offering stronger relative value, even if they’re not a bargain in absolute terms. Image: Goldman Sachs Global Investment Research