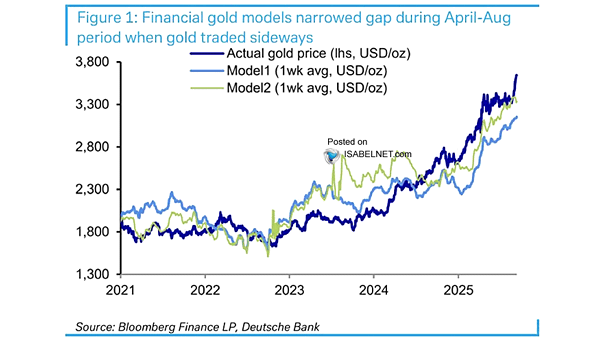

Financial Gold Models

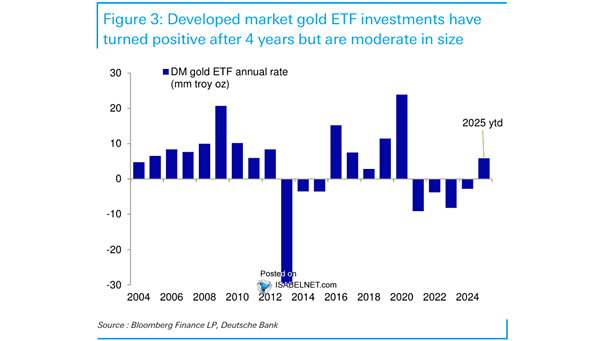

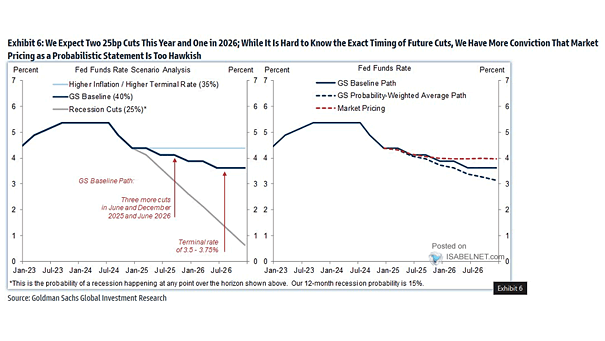

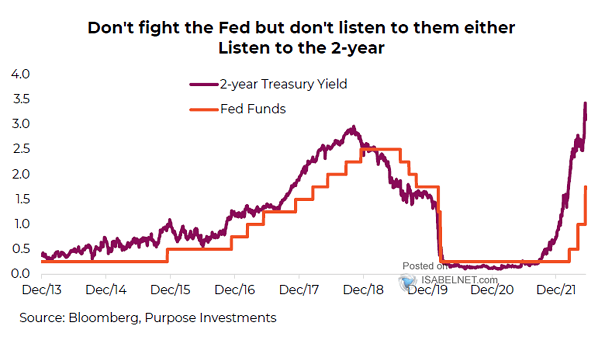

Financial Gold Models Deutsche Bank has raised its gold price forecast to an average of $4,000 per ounce for 2026, driven by strong central bank buying, a weakening U.S. dollar, expected Fed rate cuts, and ongoing global uncertainties. Image: Deutsche Bank