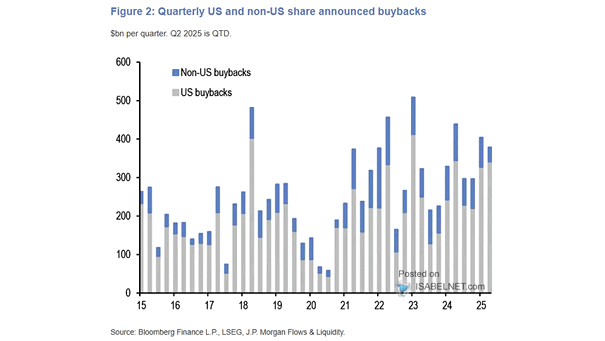

U.S. and Non-U.S. Share Announced Buybacks by Year

U.S. and Non-U.S. Share Announced Buybacks by Year JPMorgan strategists expect further strong growth in buyback volumes, noting that the first eight months of 2025 have already matched last year’s total, providing ongoing support for equity markets. Image: J.P. Morgan