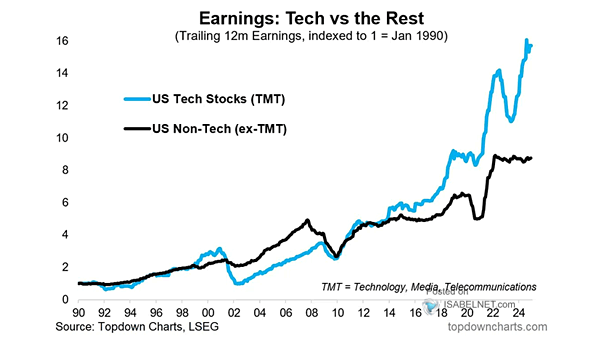

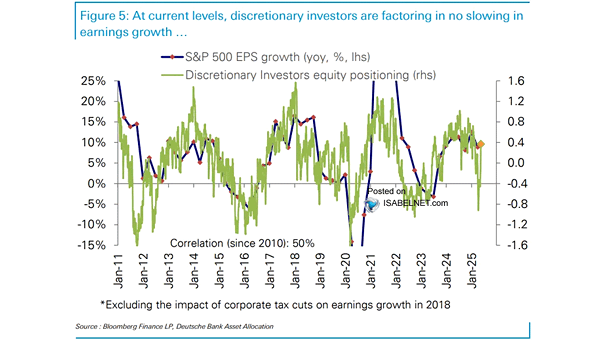

Earnings of Tech Companies

Earnings of Tech Companies While U.S. tech stocks benefit from a wave of strong performance fueled by both hype and solid earnings fundamentals, non-tech stocks continue to experience prolonged earnings stagnation. Image: Topdown Charts