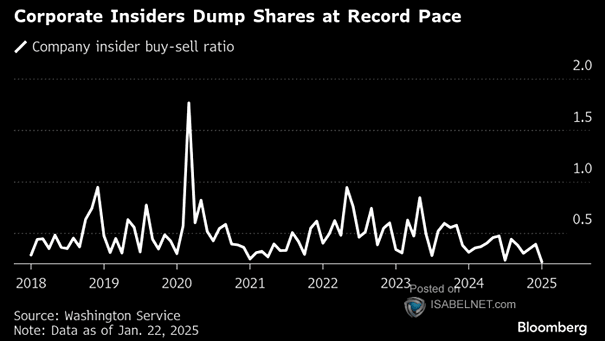

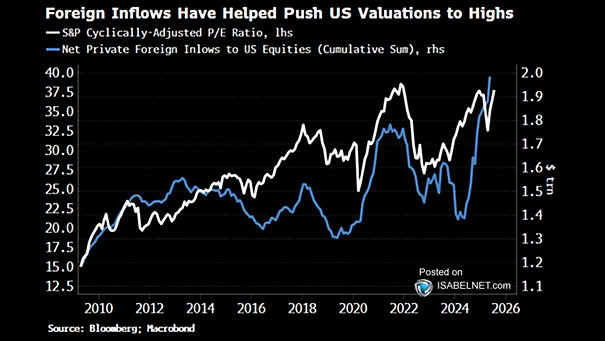

Company Insider Buy-Sell Ratio

Company Insider Buy-Sell Ratio Insider buying has recently dried up, with insider purchases falling behind insider sales by the most since July 2024—this may reflect either executive caution or opportunistic profit-taking. Image: Bloomberg