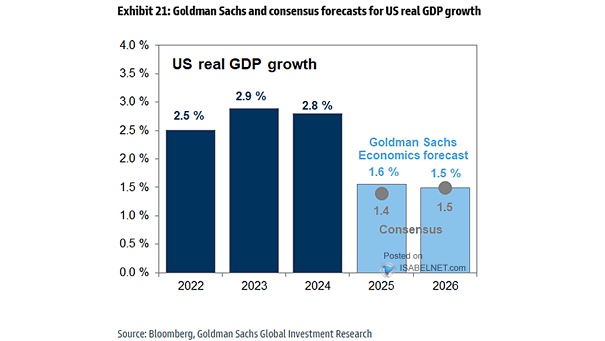

U.S. Real GDP Growth

U.S. Real GDP Growth Goldman Sachs is betting on a still-solid U.S. economy, calling for growth of 2.9% in 2026 and 2.1% in 2027, topping consensus forecasts as cooling inflation and firm hiring underpin the expansion. Image: Goldman Sachs Global Investment Research