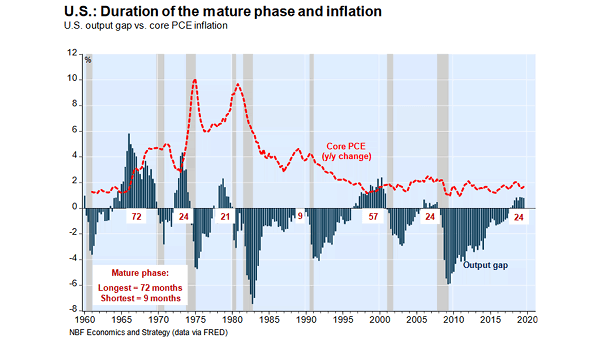

U.S. Business Cycle: Output Gap vs. Core PCE Inflation

U.S. Business Cycle: Output Gap vs. Core PCE Inflation The mature phase of the U.S. business cycle began 24 months ago. The mature phase lasted 72 months in the late 1960s and 57 months in the late 1990s. Image: NBF Economics and Strategy