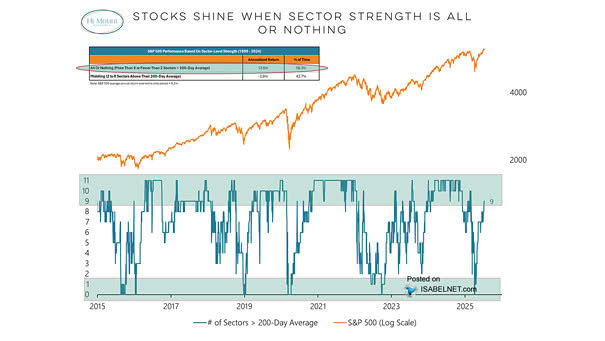

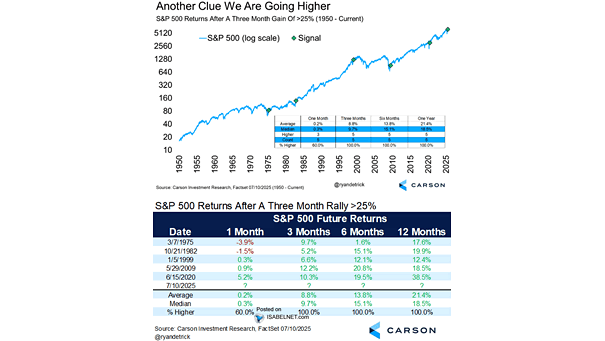

S&P 500 Performance Based on Sector-Level Strength

S&P 500 Performance Based on Sector-Level Strength Long-term S&P 500 gains have historically followed periods of either broad market participation, where over eight sectors trade above their 200-day moving average, or extreme oversold conditions, with fewer than two sectors doing so. Image: Hi Mount Research