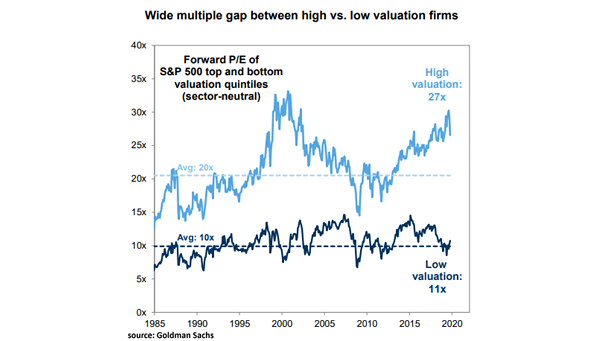

Forward P/E of S&P 500 Top and Bottom Valuation Quintiles

Forward P/E of S&P 500 Top and Bottom Valuation Quintiles The forward P/E of the top quintile of S&P 500 companies by valuation is 27 (avg: 20) vs. 11 (avg: 10) for the lowest quintile. Image: Goldman Sachs Global Investment Research