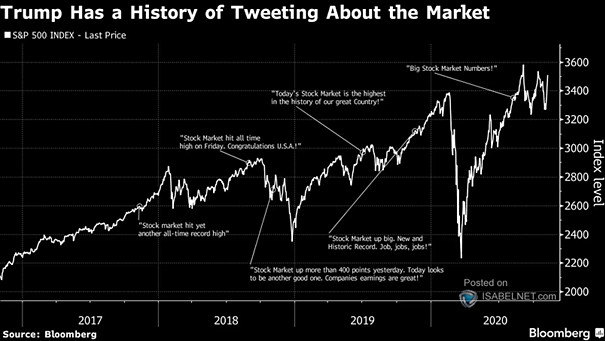

President Trump Tweets Contribute to Market Volatility

President Trump Tweets Contribute to Market Volatility President Trump’s tweets during his first term had a significant impact on financial markets, often contributing to increased volatility. During Trump’s second term, the dynamics appear similar. Image: Bloomberg