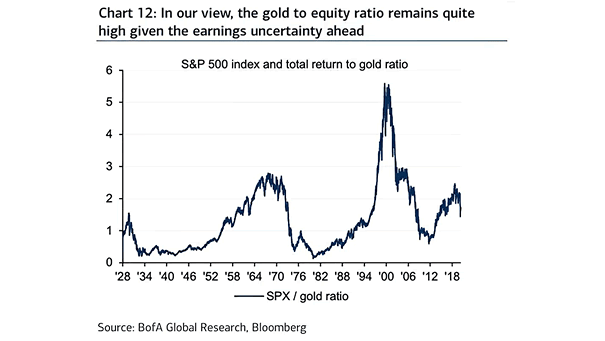

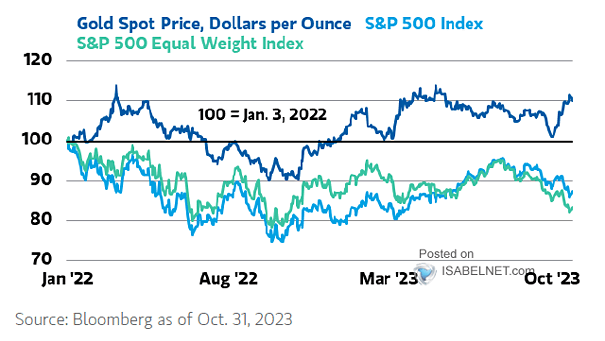

Gold to S&P 500 Ratio

Gold to S&P 500 Ratio Gold’s outperformance has pushed the Gold-to-S&P 500 ratio to its highest since 2013, signaling a defensive shift but not yet the kind of rush to safety seen during crisis years. Image: Goldman Sachs Global Investment Research