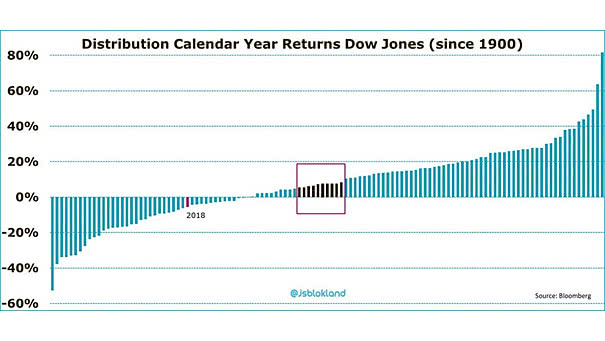

Distribution of Calendar Year Returns: Dow Jones since 1900

Distribution of Calendar Year Returns: Dow Jones since 1900 The chart shows the calendar year returns on the Dow Jones since 1900, from lowest to highest. It also show that an average return (black bars) does not really exist if we take into account the distribution of calendar year returns since 118 years. Image: Jeroen Blokland