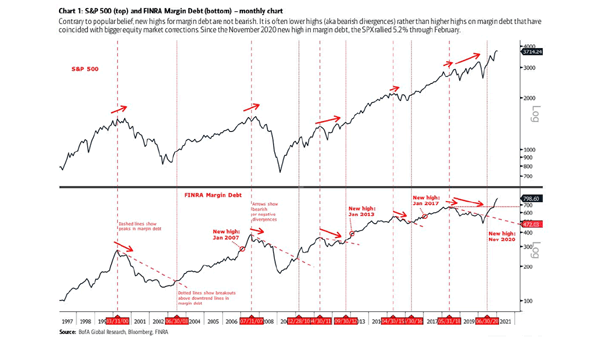

Margin Debt and MoM Change

Margin Debt and MoM Change The recent three-month, $90 billion decline in margin debt is not characteristic of what is typically observed at market tops, where margin debt tends to rise or peak amid speculative excess. Image: Fundstrat Global Advisors, LLC