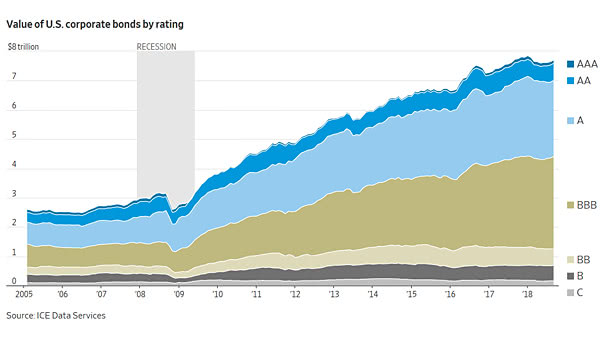

Value of U.S. Corporate Bonds by Rating

Value of U.S. Corporate Bonds by Rating Since the Great Recession, the U.S. corporate bond debt rated ‘BBB’ exceeds $3 trillion. If the U.S. economy goes wrong, this is bad news for investors. Image: The Wall Street Journal