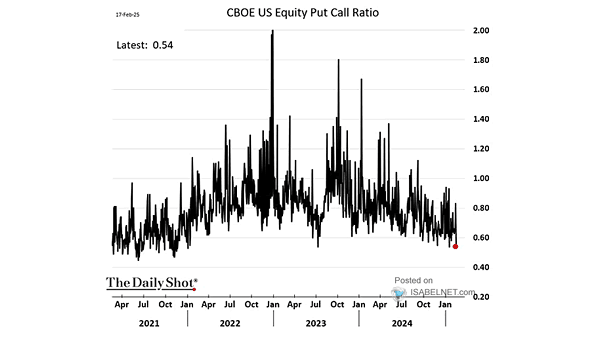

Sentiment – CBOE Equity Put/Call Ratio

Sentiment – CBOE Equity Put/Call Ratio The current U.S. equity put/call ratio indicates a broadly bullish sentiment, implying that investors are confident about the market’s future performance, for now. Image: The Daily Shot