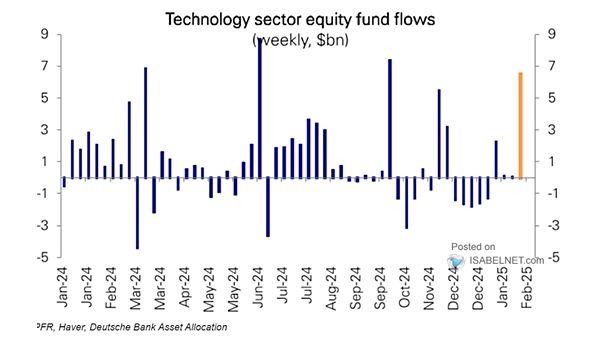

Tech Equity Flows

Tech Equity Flows The DeepSeek selloff was followed by significant tech inflows, highlighting the resilience of investor confidence in the technology sector, despite short-term market fluctuations. Image: Deutsche Bank Asset Allocation