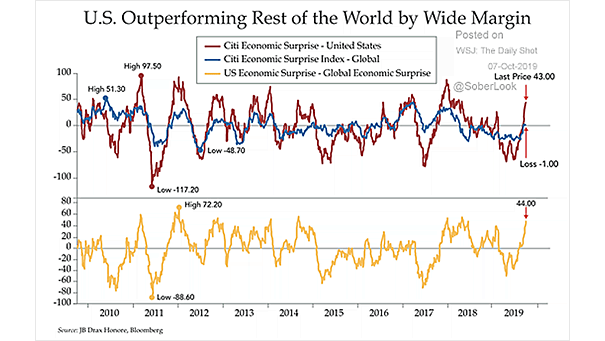

U.S. and Global Economic Surprises

U.S. and Global Economic Surprises Global economic surprises have surged to a two‑year high, with the U.S. gaining momentum, a mix that usually bodes well for stocks and credit in the near term. Image: Societe Generale Cross Asset Research