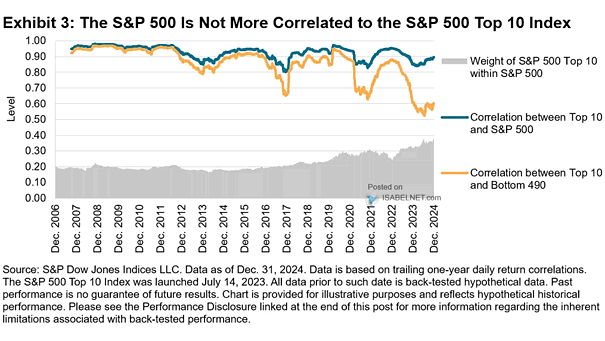

Correlation Between Top 10 and S&P 500

Correlation Between Top 10 and S&P 500 While the concentration of large-cap stocks in the U.S. equity market is a topic of discussion, the evidence suggests that its impact on market behavior is not as alarming as some might believe. Image: S&P Dow Jones Indices