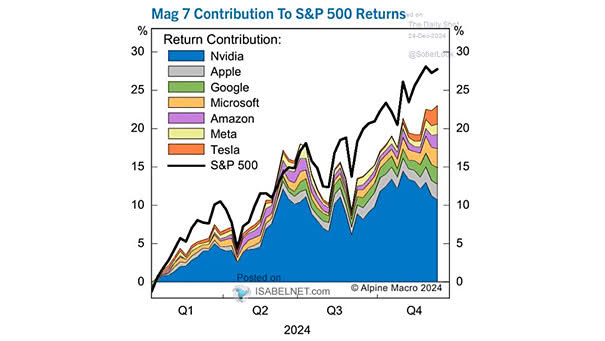

Magnificent Seven Contribution to S&P 500 Returns

Magnificent Seven Contribution to S&P 500 Returns The Magnificent Seven stocks have played a crucial role in driving the S&P 500’s performance in 2024, continuing the momentum from their remarkable gains in 2023. Image: Alpine Macro