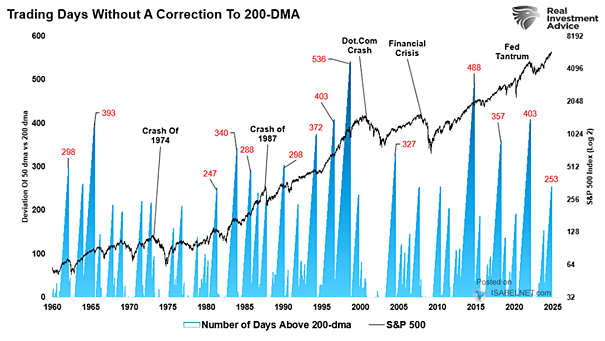

S&P 500 and Days Without a Correction to 200-Day Moving Average

S&P 500 and Days Without a Correction to 200-Day Moving Average The S&P 500 is experiencing an impressive streak of 253 trading days without a correction to its 200-day moving average, indicating strong bullish momentum…