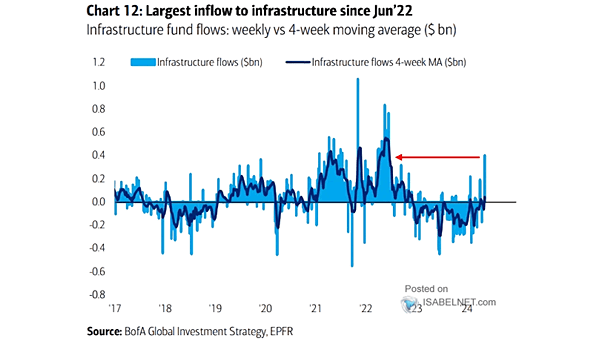

Infrastructure Flows

Infrastructure Flows Infrastructure funds have seen their largest inflow since June 2022, signaling a positive trend for investors aiming for long-term returns and portfolio diversification. Image: BofA Global Investment Strategy