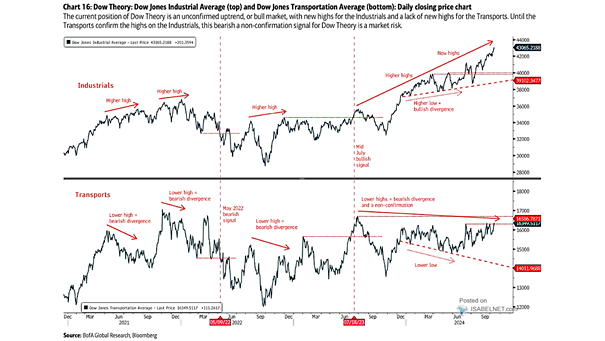

Dow Theory – Dow Jones Industrial Average and Dow Jones Transportation Average

Dow Theory – Dow Jones Industrial Average and Dow Jones Transportation Average Currently, the Dow Jones Transportation Average has not confirmed the recent highs of the Dow Jones Industrial Average, which is viewed as a…