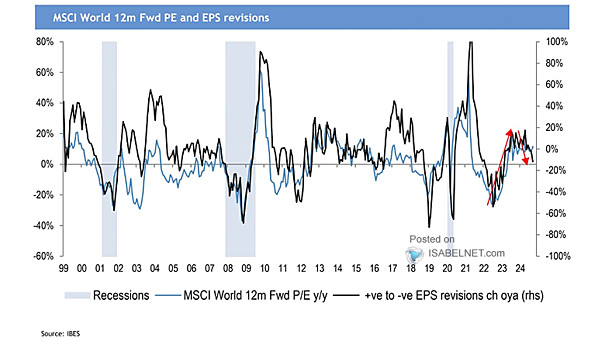

Valuation – MSCI World P/E

MSCI World Fwd PE and EPS Revisions Downward revisions in global EPS raise concerns, suggesting that the global economic landscape is precarious, prompting central banks to adopt more aggressive strategies to stimulate growth. Image: J.P.…