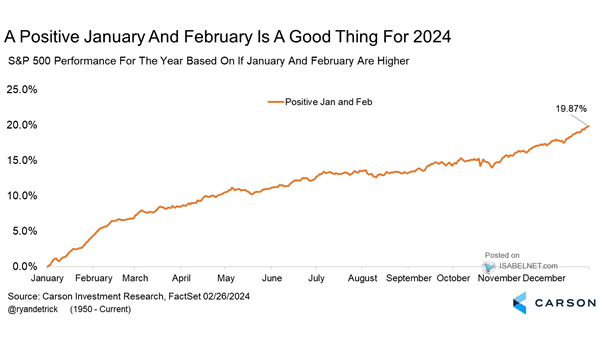

S&P 500 Performance for the Year Based on If January and February Are Higher

S&P 500 Performance for the Year Based on If January and February Are Higher Since 1950, when both January and February have been positive for the S&P 500, the average annual gain has historically been…