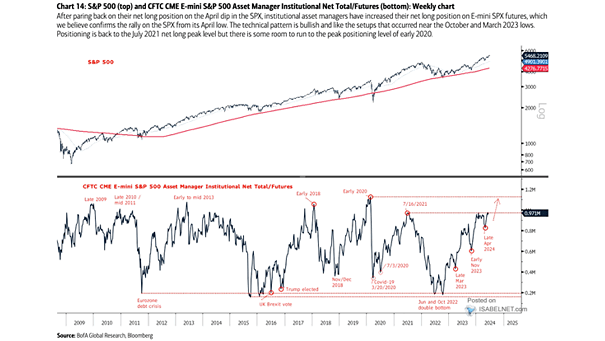

S&P 500 and CFTC CME E-mini S&P 500 Asset Manager Institutional Net Total/Futures

S&P 500 and CFTC CME E-mini S&P 500 Asset Manager Institutional Net Total/Futures The net long position held by institutional asset managers on E-mini S&P 500 futures has been rising, with the potential to reach…