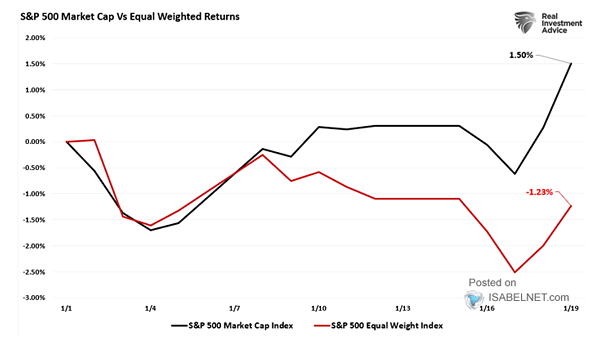

S&P 500 Equal Weight Index vs. S&P 500 Index

S&P 500 Equal Weight Index vs. S&P 500 Index While the S&P 500 Equal Weight Index has historically performed well during economic recoveries, it continues to underperform the S&P 500 (Market-Cap) Index this year. Image:…