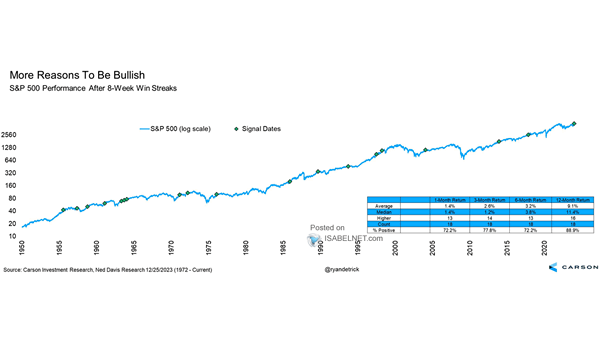

S&P 500 Performance After 8-Week Win Streaks

S&P 500 Performance After 8-Week Win Streaks Historically, 8-week win streaks tend to be bullish for U.S. stocks over the next 12 months, giving investors a potential reason to expect a positive year in 2024.…