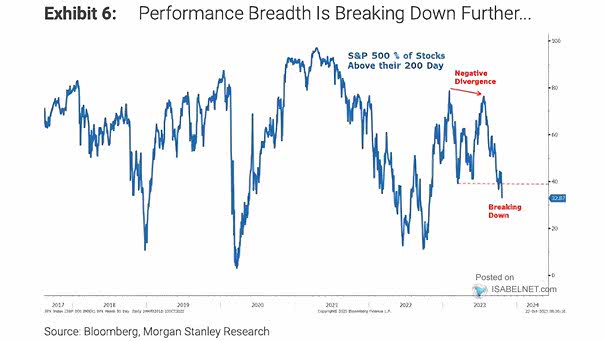

S&P 500 % of Members Above 200-Day Moving Average

S&P 500 % of Members Above 200-Day Moving Average A limited number of U.S. stocks driving market performance due to a lack of broad market participation can be problematic, potentially resulting in a less sustainable…