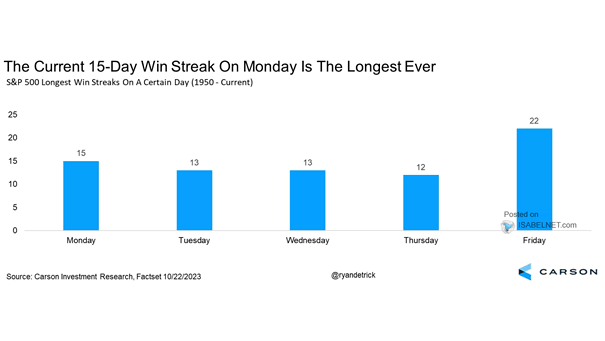

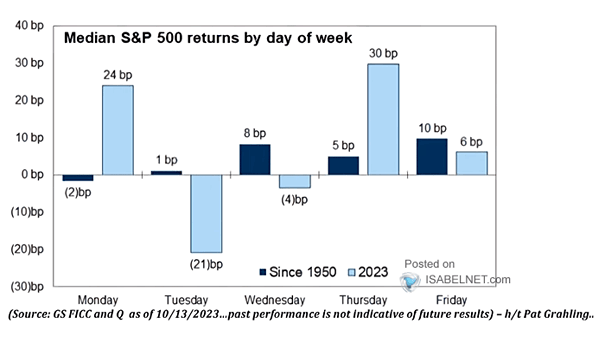

S&P 500 Longest Win Streaks on a Certain Day

S&P 500 Longest Win Streaks on a Certain Day The S&P 500 achieved a remarkable feat on Monday, as it recorded a record-breaking 15-day win streak. This streak represents the longest period of consecutive gains…