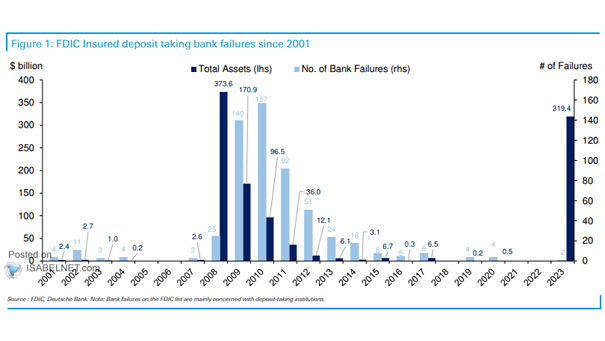

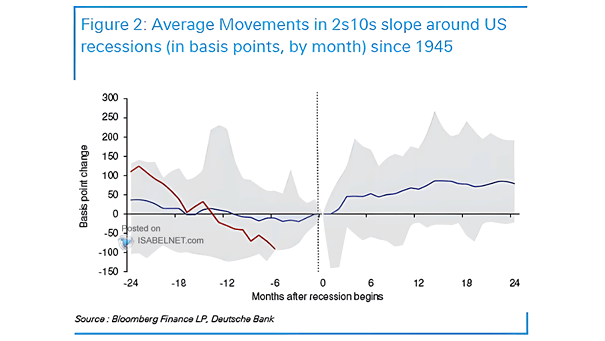

FDIC Insured Deposit Taking Bank Failures

FDIC Insured Deposit Taking Bank Failures There have been hundreds of bank failures in the United States over the past two decades, which can have significant consequences for individuals and organizations. Image: Deutsche Bank