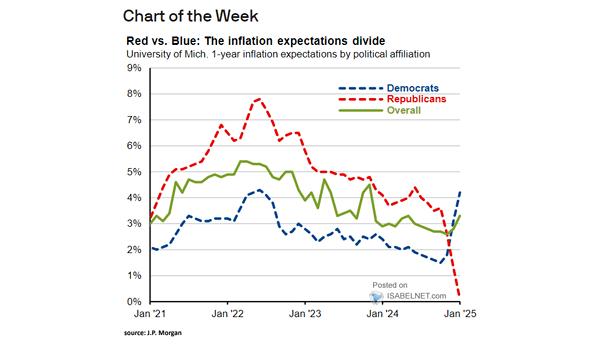

U.S. Consumer Inflation Expectations

U.S. Consumer Inflation Expectations U.S. households aren’t convinced the Fed has inflation under control. Expectations for the next year sit above the 2% goal, and longer-term views hover near 3%. Could easing too fast entrench…