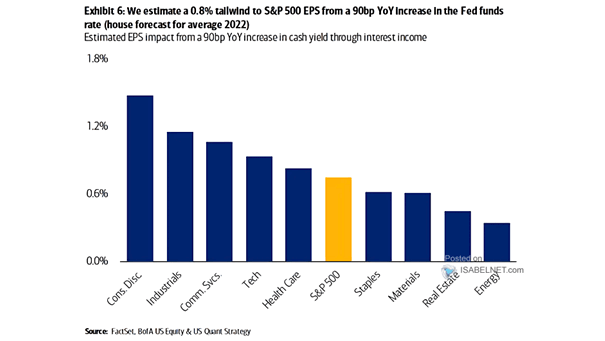

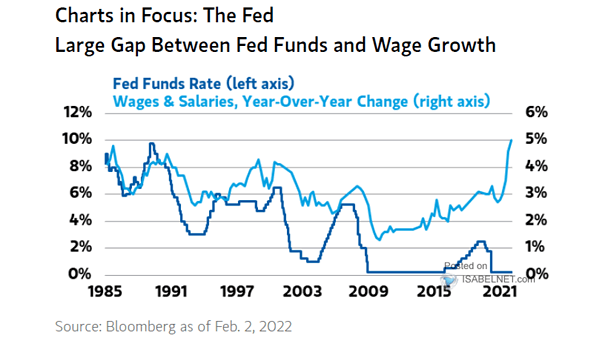

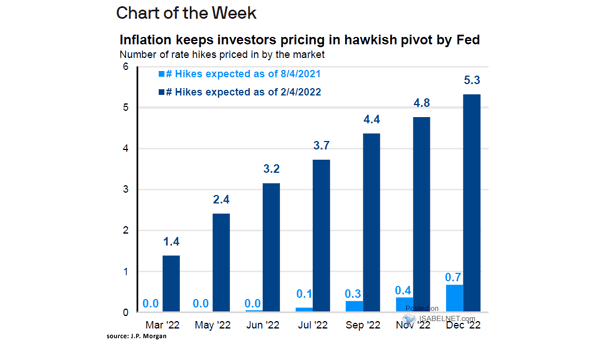

Estimated EPS Impact from a 90bp YoY Increase in Cash Yield Through Interest Income

Estimated EPS Impact from a 90bp YoY Increase in Cash Yield Through Interest Income Historically, the S&P 500 tends to do well during Fed hike cycles. Image: BofA US Equity & Quant Strategy