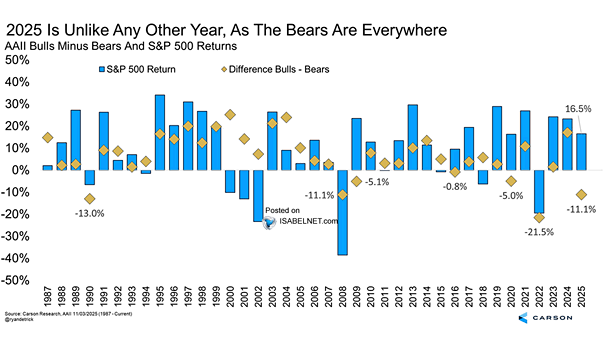

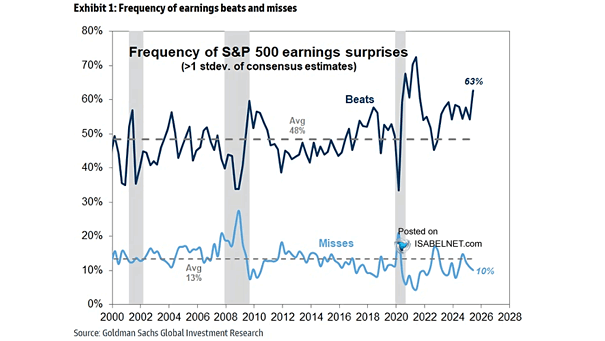

Share of S&P 500 Company Quarter-Ahead EPS Guidance Above Consensus Estimates

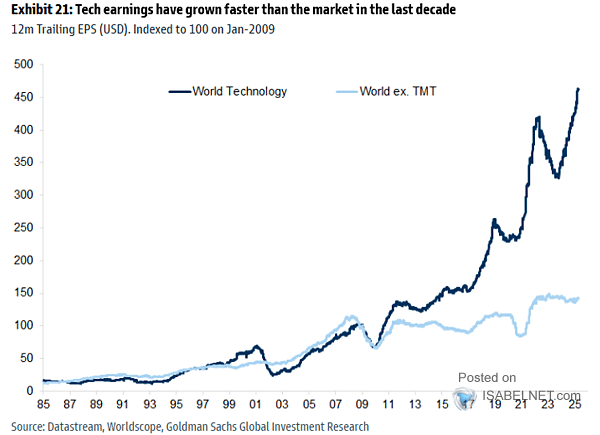

Share of S&P 500 Company Quarter-Ahead EPS Guidance Above Consensus Estimates Robust earnings and upbeat company guidance are keeping corporate America in a bullish mood about near‑term profits, lending fresh support to elevated equity valuations.…