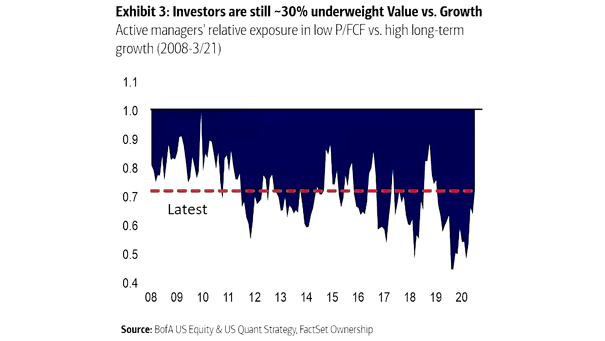

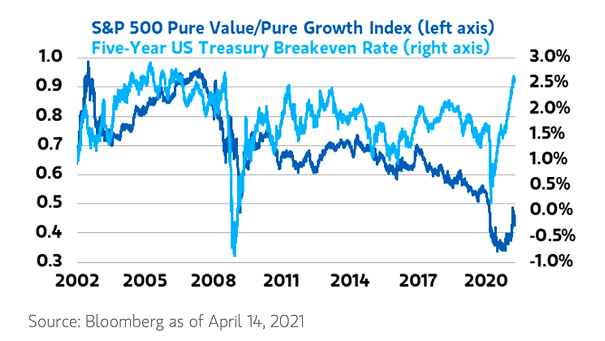

Value vs. Growth – Active Managers’ Relative Exposure in Low P/FCF vs. High Long-Term Growth

Value vs. Growth – Active Managers’ Relative Exposure in Low P/FCF vs. High Long-Term Growth Despite the rally in Value, active managers are still ~30% underweight Value vs. Growth. Image: BofA US Equity & Quant…