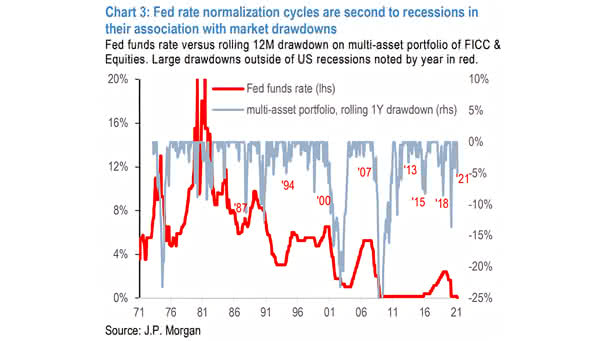

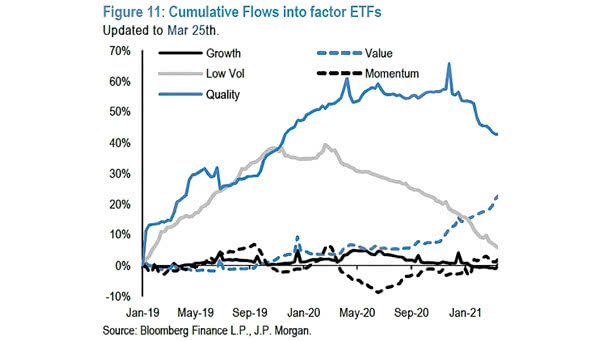

Recessions – Fed Funds Rate vs. Rolling 12-Month Drawdown on Multi-Asset Portfolio of FICC and Equities

Recessions – Fed Funds Rate vs. Rolling 12-Month Drawdown on Multi-Asset Portfolio of FICC and Equities Could the Fed cause the next recession by raising interest rates too soon? Image: J.P. Morgan