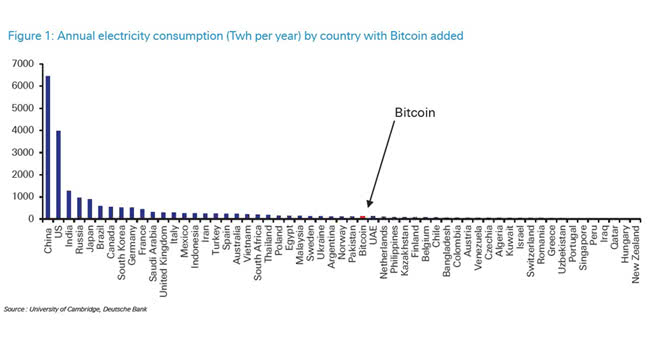

Annual Electricity Consumption (Twh) by Country with Bitcoin Added

Annual Electricity Consumption (Twh) by Country with Bitcoin Added One Bitcoin transaction uses the same amount of electricity as around 500,000 Visa transactions. Image: Deutsche Bank