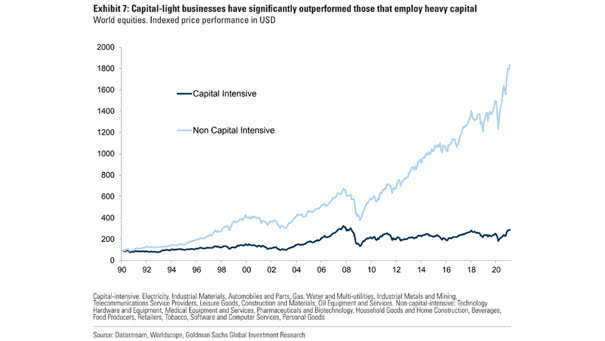

World Equities Performance – Capital Intensive Companies vs. Non Capital Intensive Companies

World Equities Performance – Capital Intensive Companies vs. Non Capital Intensive Companies Equity markets tend to penalize capital-intensive companies. Image: Goldman Sachs Global Investment Research