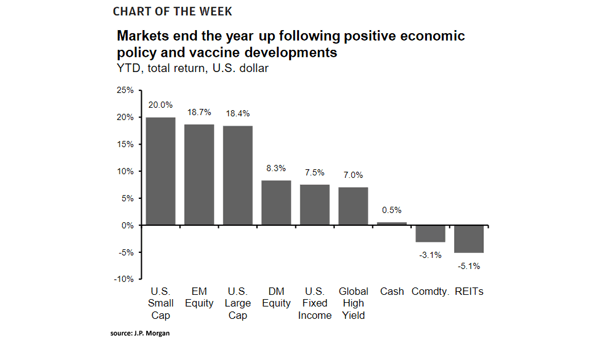

Markets Total Return in 2020

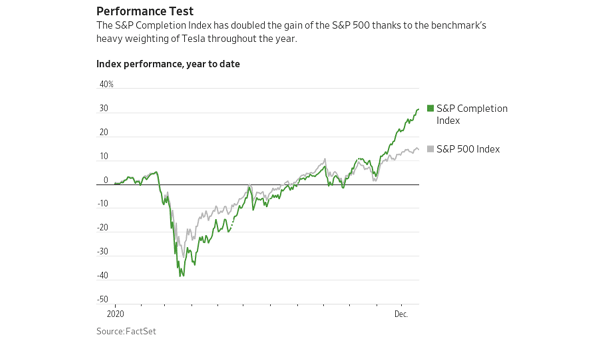

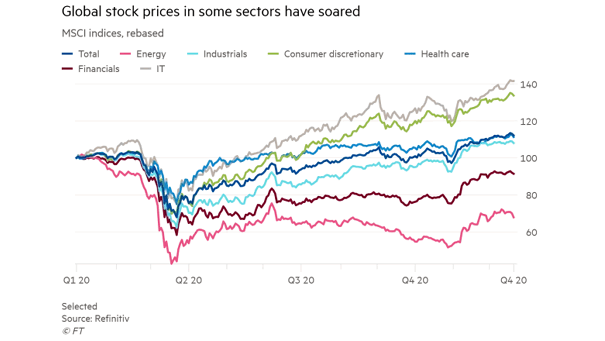

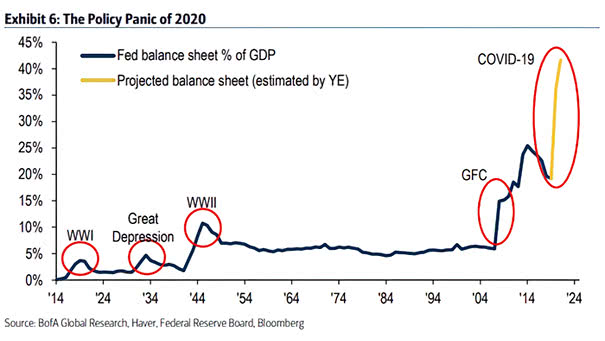

Markets Total Return in 2020 The coronavirus pandemic drove strong market gains in 2020, thanks to unprecedented monetary and fiscal stimulus, as well as positive news on vaccine development. Image: J.P. Morgan Asset Management