VIX – The Pricing of Election Risks in U.S. Equity Volatility Markets

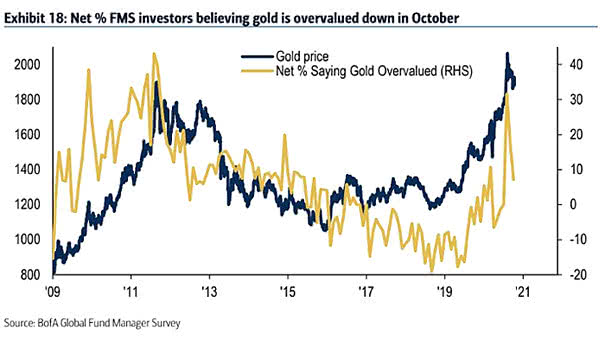

VIX – The Pricing of Election Risks in U.S. Equity Volatility Markets The volatility priced into the U.S. election this year is significantly higher than in 2016. Image: BofA Global Research